Instead of agreeing to have rental payments until the individual is qualified for a loan, a seller will let the buyer pay rent until they pay the seller for the home in full. When a seller enters into a Contract for Deed agreement, the buyer is entering into another type of "rent-to-own" arrangement. If the home doesn't have home warranty insurance, it may be hard to buy a home, as home warranty insurance can save a homeowner hundreds of dollars a year. If there are loopholes in the contract, the buyer should look for another home "“ preferably one covered by home warranty insurance. Then, a real estate agent hired by the buyer should properly vet the contract. The best way to combat this mortgage scam is to make sure there is a written contract between the seller and the buyer of the home.

Or, if the seller wants to make money, they'll charge more from the buyer on the mortgage payment, pay their minimum to the bank, and pocket the rest. If the seller doesn't make payments to the bank, the home will be foreclosed and the buyer is kicked out. Some sellers in this situation scam the buyer. When the buyer pays money to the seller, the seller pays it on their mortgage to the bank. This "mortgage" wraps around the mortgage the seller has on the home already. Wraparound Mortgagesįor individuals who cannot qualify for a home loan, a scamming seller will provide a mortgage instead of a traditional lender. Home warranty insurance could also be included in a home sale. With this lower rate, homeowners can purchase home warranty insurance and save money by protecting their systems and appliances. Some can find mortgages for low credit or low-income individuals. If you don't qualify for a mortgage, talk to your local Approved Housing Counseling Agencies. The seller can then kick them out of the home and keep all of the rental payments and opt-in money. Worse than that is when the contract states it's time for the buyer to purchase the home outright, and they still cannot qualify for a home loan. However, these rental payments are usually overpriced. Many times a lease-to-own mortgage seems like a great deal.The buyer pays "rental" payments until they can buy the home outright. Often times the seller charges "opt-in" money at the start of a lease to own agreement, which shows the buyers intent to purchase the home after qualifying. Instead, the seller becomes a landlord for a time and charges rent to the homeowners, until they can build up their credit and qualify for a mortgage.

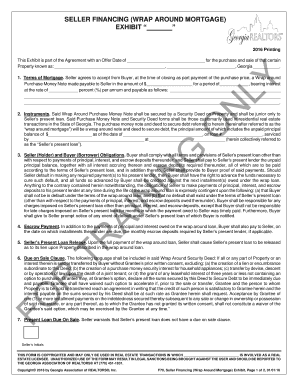

WRAPAROUND LOAN HOW TO

Landmark outlines three possible mortgage scams and how to avoid them.Ī lease to own mortgage is usually something offered by the seller when an interested buyer doesn't qualify for a loan to pay for the home up front. These individuals sometimes can get trapped in home mortgage scams where they lose money and their new home.

It's especially hard for individuals who aren't able to pay for a home in cash and don't qualify for a mortgage loan from a lender. Buying a home has so many caveats and limitations that it may be hard to find a dream home.

0 kommentar(er)

0 kommentar(er)